Xero makes small-business accounting simple, accurate, and fast with real-time automation.

You started a business to serve customers, not to chase receipts, reconcile bank feeds, or dread tax time. The right tool can turn messy books into clear numbers you trust. That is where Accounting with xero shines. It puts invoicing, bills, bank reconciliation, payroll add-ons, and reporting in one clean hub. I tried it to see if it truly saves time and stress. Here is what I found, step by step.

What is Xero?

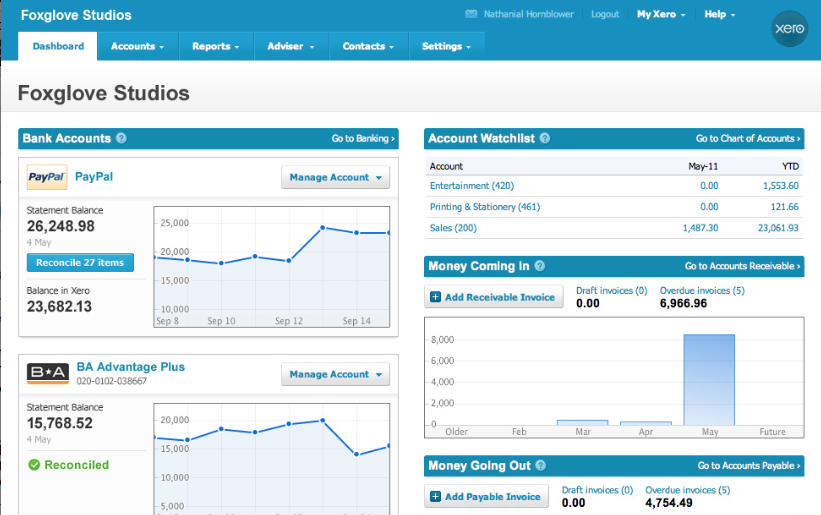

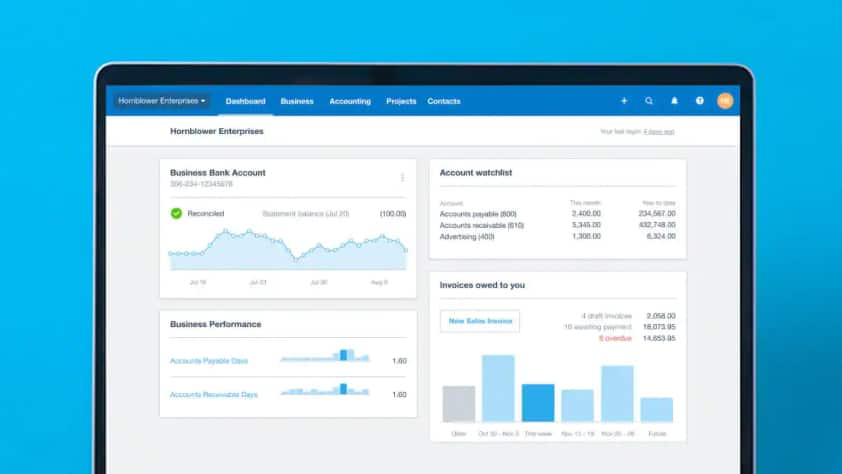

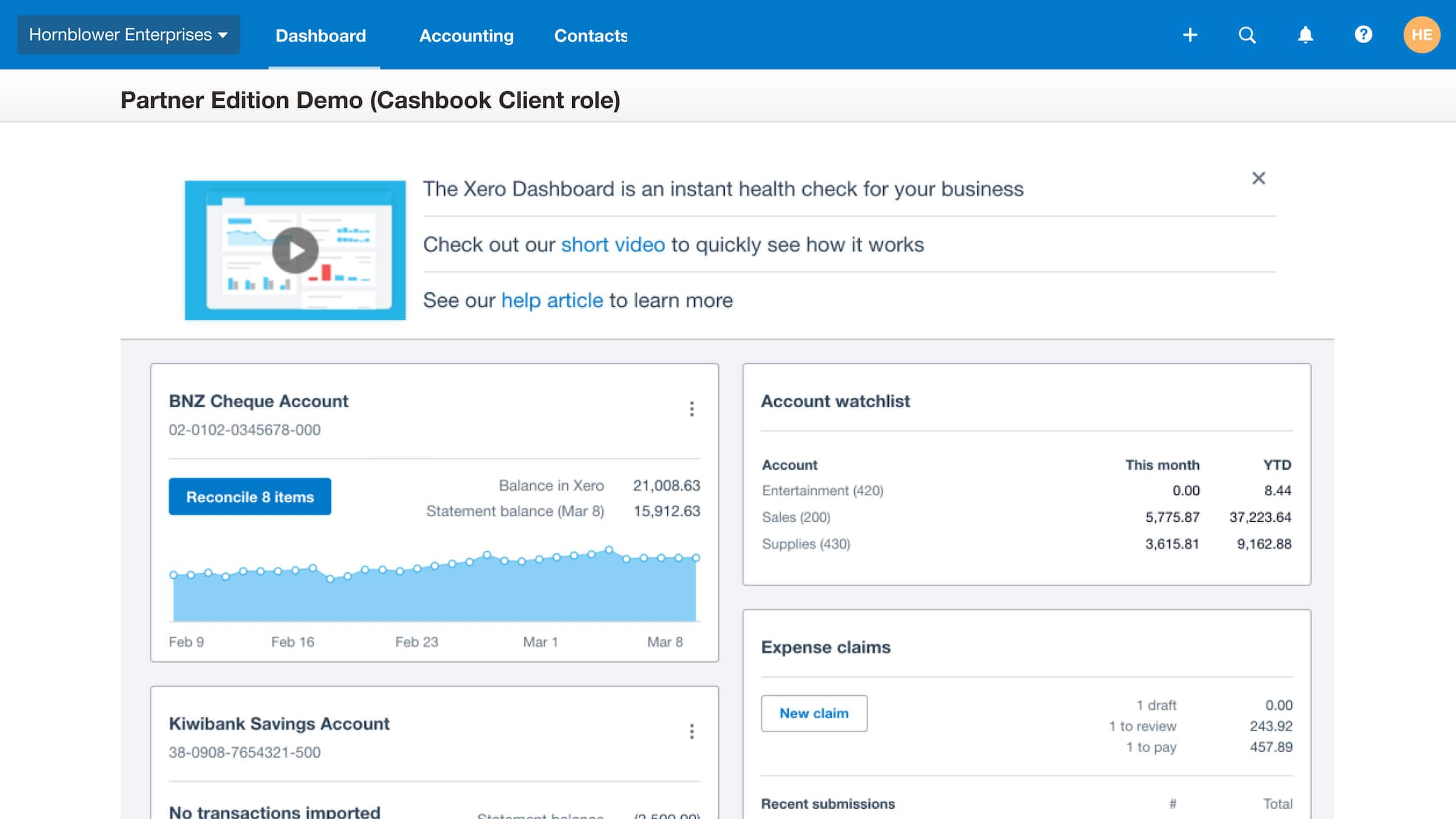

Xero is a cloud-based accounting platform for small and mid-sized businesses. It helps you send invoices, track bills and expenses, reconcile bank transactions, run reports, manage projects, and collaborate with your accountant in real time. The software claims to automate routine tasks so you can see cash flow at a glance and make faster choices. If you want Accounting with xero to feel easy, this tool aims to deliver that with clean design and strong integrations.

My Personal Experience & In-Depth Walkthrough:

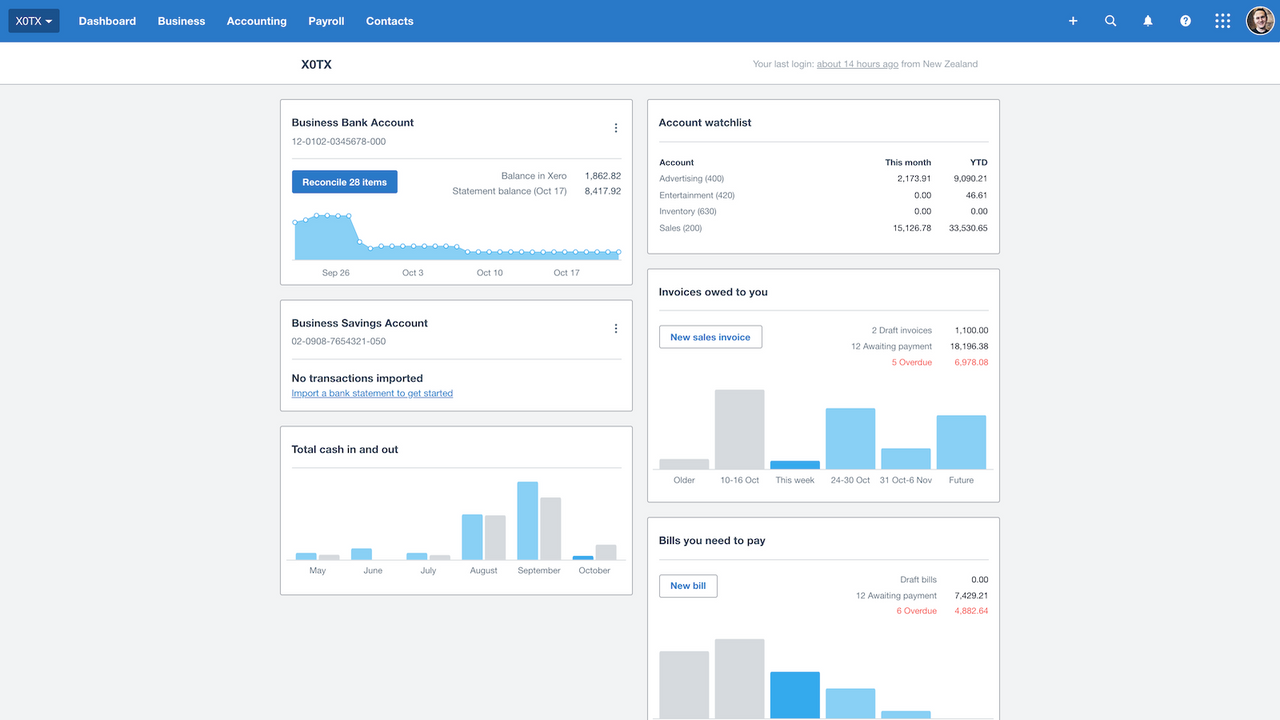

For the last 72 hours, I set up a test company and ran my week like a busy owner. I began by connecting a bank feed. It took a few clicks. Xero matched past transactions with my draft bills and invoices. The matching was fast and accurate. That is a big win for Accounting with xero because clean bank data saves hours.

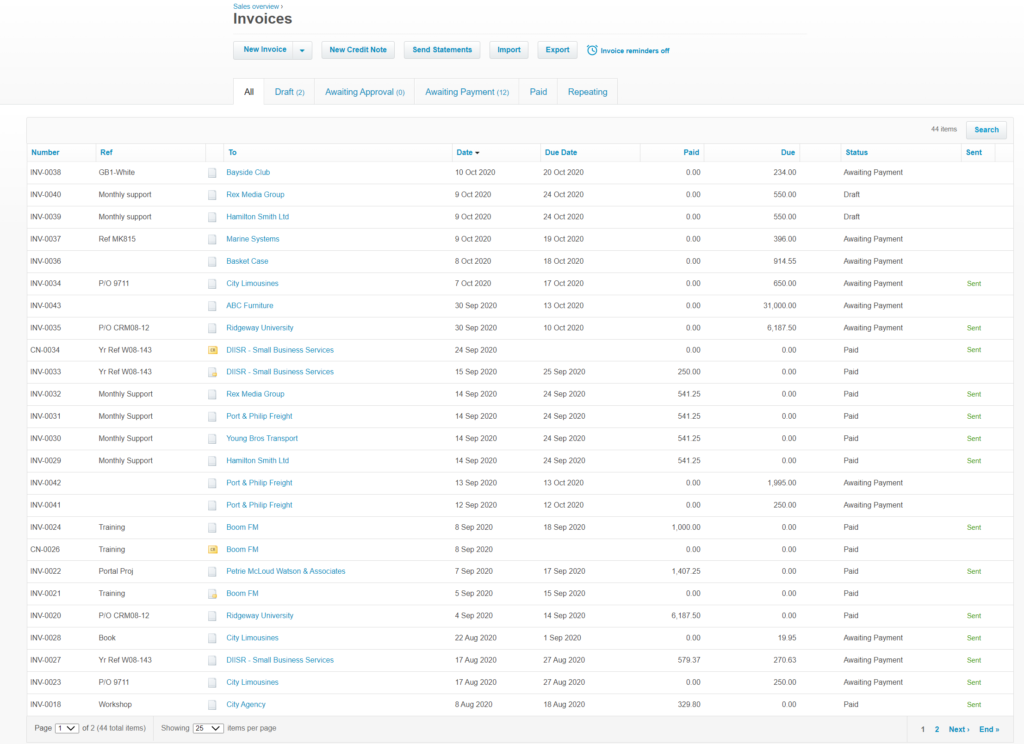

Next, I built a custom invoice template and sent a test invoice. I liked the live preview and the option to accept online payments. The payment link reduced friction for the client. That is a major pro in Accounting with xero for faster cash collection. I also tested recurring invoices and automatic reminders. Reminders were polite and clear. I could tweak timing and tone.

Then I added vendor bills by email. Xero read the PDF details well. Line items needed a quick glance, but the import was solid. I set rules to auto-code repeat costs. This is where Accounting with xero feels like magic. Rules cut down clicks and reduce errors.

I explored Projects to track time and costs. The time tracking was basic but neat. I pushed a project cost to an invoice in seconds. Reports updated right away. For service teams, this is a big plus. Inventory also worked well for simple stock needs. It is fine for basic SKUs. If you need deep manufacturing, you will want an add-on. That’s a con to note.

I connected a few apps: a CRM, a payment processor, and a receipt scanner. App setup was smooth. The Xero App Store is large, so you can extend features as you grow. This makes Accounting with xero scale better than many tools. I also invited an accountant user. They jumped in, fixed a few codes, and left notes. The collaboration was easy.

Two drawbacks stood out. First, advanced reporting took some clicks to master. New users may feel lost with tracking categories and layouts. Second, multi-currency is not in the entry plan. You need a higher tier. Keep that in mind if you sell abroad. Even so, day-to-day tasks were fast. My books looked clean. I could see cash by week and month. That builds trust, and trust is the core of Accounting with xero.

What Makes It Stand Out / Key Features

- Real-time bank feeds with smart reconciliation and custom rules

- Professional invoicing with online payments, recurring billing, and reminders

- Bills and expenses capture from email and mobile with receipt parsing

- Projects and time tracking for basic job costing and profitability

- Inventory tracking for simple stock workflows and cost of goods sold

- Multi-currency support with live exchange rates (in higher plan)

- Strong reporting with tracking categories and quick cash flow views

- Secure collaboration with your accountant and role-based access

- Rich ecosystem: 1,000+ integrations in the Xero App Store

- Mobile apps for invoicing, receipts, and bank reconciliation on the go

What I Like

- Setup is quick and guided. I got value on day one.

- Bank rules do the boring work. Fewer clicks. Fewer errors.

- Invoices look sharp and help you get paid faster.

- App integrations let you tailor your stack as you grow.

- Collaboration is smooth. Your accountant can fix issues in minutes.

- Reporting is flexible once you learn tracking categories.

- Accounting with xero feels light yet capable for most small teams.

- Solid mobile apps make it easy to clear bank feeds anywhere.

What Can be improved

- Advanced reporting has a learning curve for new users.

- Multi-currency and advanced features sit behind higher tiers.

- Inventory is fine for simple needs, but deeper ops need add-ons. This may add cost to Accounting with xero.

Pricing And Affordability

Pricing varies by country and promotions. Below is a typical US snapshot as of February 2026. Always confirm current pricing on the site.

| Plan | Best for | Typical monthly price (US) | Key inclusions |

|---|---|---|---|

| Early | Freelancers, new micro-business | $15–$20 | Core accounting, invoicing, bills, bank feeds, limited transaction volumes |

| Growing | Small teams ready to scale | $40–$50 | Unlimited invoices/bills, bank rules, bulk reconcile, basic reporting |

| Established | Multi-currency and advanced needs | $75–$90 | Multi-currency, Projects, Expenses, advanced analytics, deeper automation |

Notes:

- Payroll: In the US, Xero integrates with Gusto (extra fee). In other regions, Xero Payroll may be available.

- Add-ons and third‑party apps can change your total cost. Plan for that in your budget.

- Accounting with xero is month-to-month. You can upgrade or downgrade as you grow.

Why should you buy Xero

If you want clean books without fuss, Xero is a safe pick. It blends ease of use with the depth most small businesses need. Bank rules, smart matching, and smooth invoicing help you win back time each week. Reports update in real time. Your accountant can log in, fix entries, and keep you compliant. Accounting with xero also scales because you can add apps for payments, CRM, inventory, and more. If you sell abroad or run projects, the higher plan adds those tools without switching systems. For owners who value clarity and speed, Xero offers a steady path to better cash flow and fewer headaches.

Comparison With Competitors of Xero

Below is a quick view to help you gauge fit. Prices are typical ranges in the US and may vary.

| Product | Best For | Starting Price (mo) | Multi-currency | Inventory (native) | Projects/Time | Ecosystem Size | Notable Edge |

|---|---|---|---|---|---|---|---|

| Xero | SMBs needing automation + clarity | $15–$20 | Yes (higher plan) | Basic | Basic | Very large | Bank rules + smooth collaboration |

| QuickBooks Online | US-centric, deep reporting | $20–$30 | Higher plans | Basic+ | Advanced | Very large | Widely adopted by US accountants |

| Zoho Books | Budget + integrated Zoho suite | $0–$20 (tiered) | Higher plans | Basic | Basic | Large | Tight link to Zoho ecosystem |

| FreshBooks | Service firms, simple invoicing | $17–$30 | Higher plans | Limited | Time tracking | Medium | Client-facing invoicing experience |

| Wave | Very small budgets | $0 core | No | No | No | Small | Free core invoicing and accounting |

FAQ Of The Accounting with xero

Is Accounting with xero good for freelancers and solo owners?

Yes. It is easy to set up, links to your bank, and sends pro invoices. You can start small and scale later. That makes Accounting with xero a safe first choice.

Does Accounting with xero work for multi-currency?

Yes, but it is part of the higher plan. You get live rates and gains/losses posted for you. If you sell abroad, Accounting with xero handles it well once enabled.

Can I run payroll with Accounting with xero in the US?

You can. Xero partners with Gusto for payroll in the US for an extra fee. In other regions, Xero Payroll may be built in. Accounting with xero keeps payroll data tied to your books.

How secure is my data when using Accounting with xero?

Xero uses encryption, access controls, and audit logs. You can add two-factor auth. Accounting with xero also lets you set user roles to protect sensitive data.

Will my accountant like Accounting with xero?

Most do. They can log in, post journals, fix codes, and run reports fast. Accounting with xero makes collaboration simple and saves billable hours.

Conclusion

Xero hits the sweet spot for small businesses that want clarity without chaos. Setup is quick, automation is strong, and reports are useful once you learn the basics. The app store fills gaps as you grow, and your accountant can work inside your file in real time. If you want less paperwork and faster payments, Xero is hard to beat. For most owners, Accounting with xero will mean fewer late nights and a better grip on cash flow.