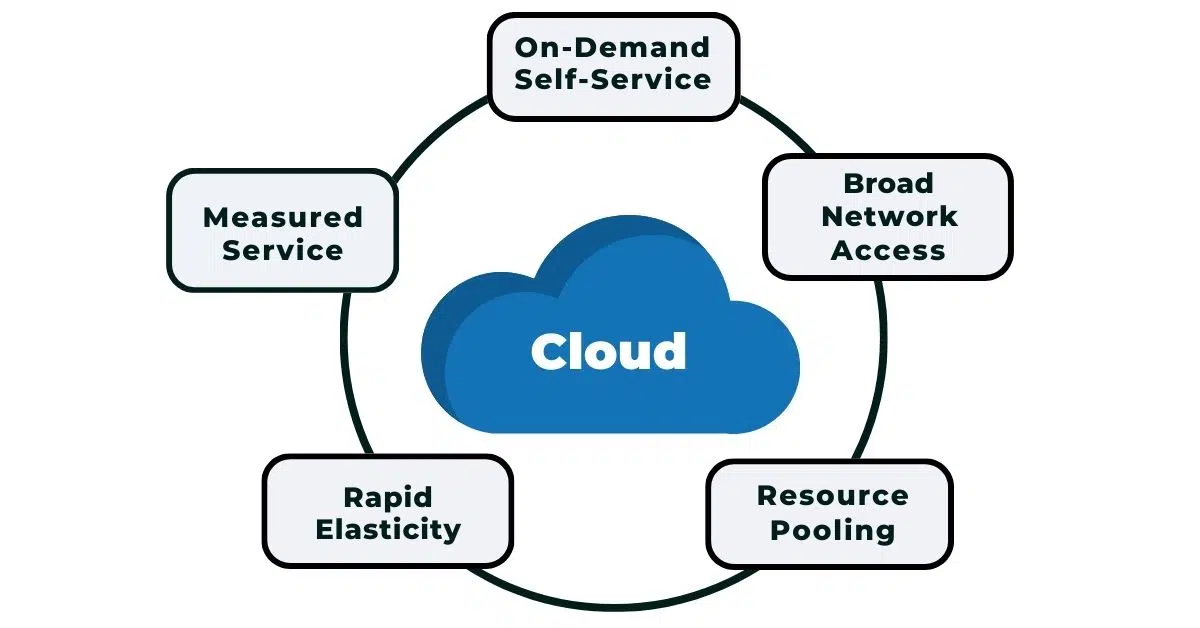

Imagine having your entire financial system accessible anytime, anywhere, without the hassle of complicated setups or costly upgrades. That’s exactly what cloud-based finance software offers you.

If you want to save time, reduce errors, and make smarter money decisions, this technology could change the way you manage your finances forever. Keep reading to discover how switching to cloud-based finance software can bring simplicity, security, and efficiency right to your fingertips.

Credit: parallelstaff.com

Faster Financial Processing

Cloud-based finance software offers real-time data access. Users can see updated numbers instantly. This helps teams make quick decisionswithout delays. Financial data is stored safely and can be checked from any device.

Automated calculationsreduce errors and save time. Manual math is replaced by software that works fast and accurately. This means fewer mistakes in budgets, invoices, and reports.

Streamlined reportingmeans reports are easier to create. Users can generate financial summaries with just a few clicks. This makes sharing information with managers or clients simple and fast.

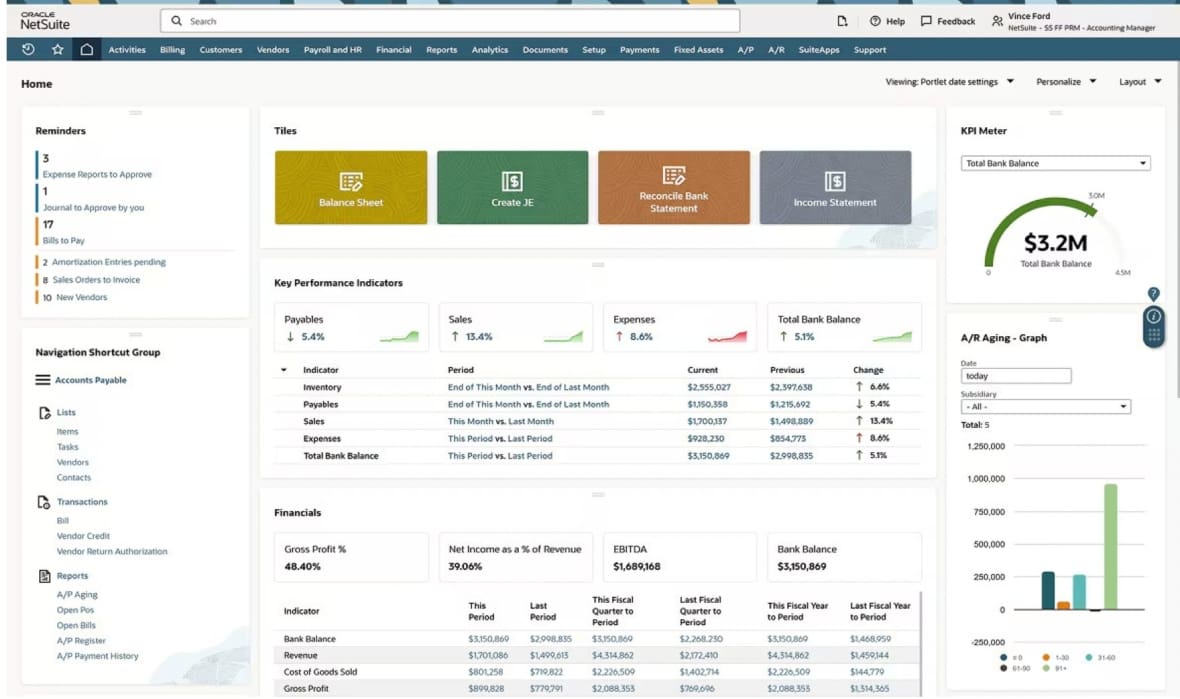

Credit: www.netsuite.com

Improved Collaboration

Multi-user accessallows many team members to work on finance tasks at once. Everyone can see changes in real time. This helps avoid mistakes and saves time.

Cloud-based communicationtools keep conversations about finances in one place. Messages, alerts, and updates are easy to find. Teams stay connected without email clutter.

Centralized document storagemeans all important files are saved online. Team members can open reports, invoices, and budgets anytime. No more lost papers or missed updates.

Cost Savings

Cloud-based finance softwarehelps cut down on IT expenses. There is no need to buy expensive hardware or servers. Software updates happen automatically, saving time and money. Lower maintenance costscome from fewer technical problems and less need for IT staff.

Pricing is often scalable. You pay only for what you use. This makes it easy to adjust costs as your business grows or shrinks. No large upfront payments. Flexible plansfit different budgets and needs.

Credit: netsuiteeexpert.wordpress.com

Enhanced Security

Data encryptionkeeps your financial information safe. It changes data into a secret code. Only those with a key can read it. This stops hackers from stealing your data.

Regular backupssave copies of your data often. If something goes wrong, you can restore your files quickly. This means less risk of losing important information.

Access controlslimit who can see or change your data. You decide who has permission. This helps stop unauthorized people from getting in.

Increased Flexibility

Cloud-based finance softwarelets users access data from anywhere. This remote accessibilitymeans work can continue outside the office. Team members can check reports and update information using any device. It saves time and boosts productivity.

Device compatibilityis another big benefit. The software works well on computers, tablets, and smartphones. This flexibility ensures users can work on their preferred device without issues. No need for special hardware or setups.

Customizable featuresallow users to tailor the software. Settings and tools can be adjusted to fit specific business needs. This makes the software more useful and easier to use. It helps companies handle finances in their own way.

Better Compliance Management

Automated updateskeep finance software current with new laws. This helps avoid mistakes and fines. Updates happen without delay, saving time and effort.

Audit trailstrack every change made in the system. This makes it easy to find errors and check data. Clear records help during audits and reviews.

Regulatory reportingis simpler with cloud software. Reports are created quickly and follow rules. This reduces stress and keeps businesses safe from penalties.

Data-driven Insights

Advanced analyticsin cloud finance software helps track spending and income clearly. It shows patterns that assist in making smart money choices. Financial forecastingpredicts future cash flow and expenses, helping businesses plan better. This reduces surprises and supports steady growth.

Performance dashboardsoffer a quick view of important numbers in one place. They help spot problems fast and see progress towards goals. Easy-to-read charts and graphs keep users informed without confusion.

Frequently Asked Questions

What Are The Key Benefits Of Cloud-based Finance Software?

Cloud-based finance software offers real-time access, enhanced security, and automatic updates. It improves collaboration and reduces IT costs, making finance management easier and more efficient for businesses.

How Does Cloud Finance Software Improve Data Security?

Cloud finance software uses encryption, multi-factor authentication, and regular backups. These features protect sensitive financial data from breaches and ensure compliance with industry standards.

Can Cloud-based Finance Software Enhance Financial Reporting?

Yes, it provides automated reporting tools with accurate, up-to-date data. This helps businesses generate insightful financial reports quickly and make informed decisions.

Is Cloud Finance Software Cost-effective For Small Businesses?

Cloud finance software reduces upfront costs by eliminating hardware needs. It offers scalable pricing models, making it affordable for small businesses to manage finances efficiently.

Conclusion

Cloud-based finance software saves time and reduces errors. It keeps your data safe and easy to access. Teams can work together from anywhere, anytime. Updates happen automatically, so you always have the latest tools. Costs stay low with no need for extra hardware.

This software helps businesses stay organized and make smart choices. Choosing cloud finance tools supports growth and efficiency. Simple, flexible, and reliable—these benefits help your business succeed.