Are you a small business owner looking to streamline your finances without breaking a sweat? Choosing the right accounting software can be your secret weapon.

Imagine having all your financial data at your fingertips, simplified and organized, so you can focus on what you do best—growing your business. We’ll dive into the best accounting software options designed specifically for small businesses like yours. These tools are not just about crunching numbers; they’re about giving you peace of mind, saving you time, and ultimately boosting your bottom line.

Stick with us, and you’ll discover which software can transform your financial chaos into clarity.

Key Features To Consider

A simple interface makes accounting easy. Buttons should be clear. Menus must be easy to navigate. Users should find tools quickly. This saves time. It also reduces frustration. Everyone can use it easily.

Growth is important for businesses. Software should grow with the business. It must handle more data. It should support more users. This prevents future problems. Businesses stay happy. They avoid changing software often.

Software should work well with other tools. It must sync with payroll systems. It should connect with banking apps. This helps smooth operations. Less manual work is needed. It boosts efficiency.

Protecting data is crucial. Software must have strong security features. It should offer encryption. Access control should be strict. This keeps information safe. Trust is built with customers.

Credit: howtostartanllc.com

Benefits Of Accounting Software

Accounting software helps save money. No need for extra staff. It reduces manual work. Software is often cheaper. It also reduces errors. Fewer mistakes mean less cost. Overall, it saves money for small businesses.

Software saves time. Tasks finish faster. No need to do manual entries. It also automates tasks. This leaves more time for other work. Time saved can be used in growing the business.

Accurate tracking is easy with software. Reports are precise. Software reduces human error. It keeps records safe. You can track sales and expenses. This helps in making good decisions.

Get detailed reports quickly. Easy access to financial data. Reports help understand business health. It shows where money goes. Helps plan for the future. Enhanced reports boost confidence in decisions.

Top Picks For Small Businesses

QuickBooks Online is popular for small businesses. It is easy to use. Track sales and expenses with it. Create invoices quickly. Many features help you manage your money. You can access it anywhere. Many users love it. It saves time. It helps keep your records clean.

Xero is known for its simple interface. It offers strong features. Connect your bank account to it. Manage your payroll with ease. It supports many integrations. This makes it flexible. Collaboration is easy with Xero. It is cloud-based. Small businesses find it very helpful.

FreshBooks is great for freelancers. It offers time tracking. Manage invoices and expenses easily. Reports are simple to read. Mobile app is available. You can work on the go. It is user-friendly. Many recommend it for small teams. It makes accounting less scary.

Zoho Books is affordable. It is designed for small businesses. Features include inventory management. Automate tasks with it. It offers online payments. Track your expenses easily. It integrates with Zoho CRM. This helps in better business management. Many small businesses trust Zoho Books.

Credit: online.jwu.edu

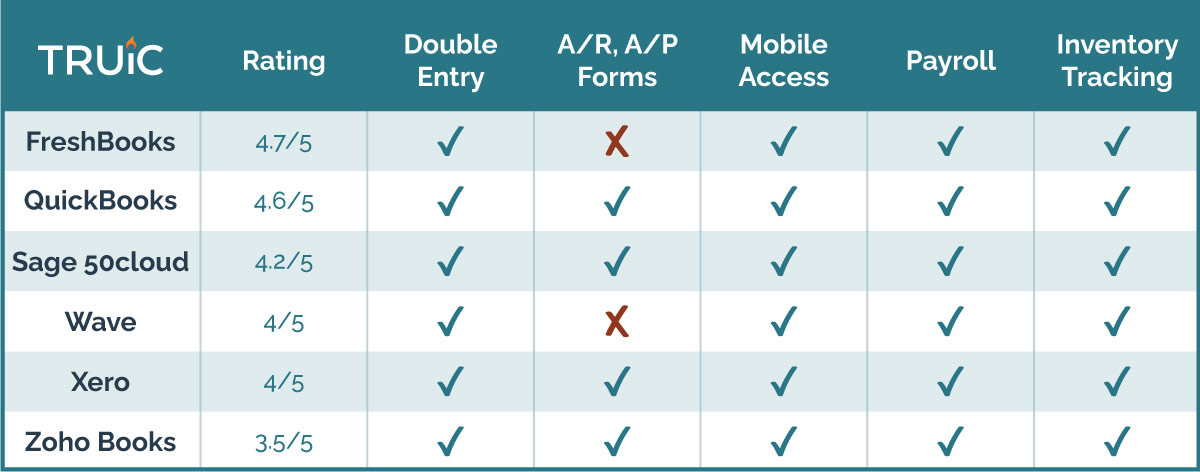

Comparison Of Features

Pricing plans vary widely among software. Some offer free basic versions. Others charge monthly fees. Each plan fits different needs. Small businesses often choose based on budget. It’s wise to compare features. Also, consider hidden costs. Free trials can be helpful. They allow testing before buying.

Software should be easy to use. Look for intuitive interfaces. Simple navigation is key. User guides are important. They help in understanding functions. Choose software with clear instructions. It saves time. Also reduces errors. Good user experience boosts efficiency.

Reliable customer support is crucial. Issues can arise anytime. Support should be available 24/7. Check for multiple contact options. Phone, email, and chat are common. Quick responses matter. They help solve problems fast. Good support enhances user satisfaction.

Mobile access is a great feature. It offers flexibility. Work from anywhere. Software should support mobile devices. Tablets and phones are common. Apps can be useful. They provide on-the-go access. Ensure compatibility with various devices. This increases productivity.

Industry-specific Solutions

Retailers need software that tracks sales and inventory. The software should offer easy reports. Reports help understand the business better. An example is QuickBooks. It is popular among retailers. It helps with sales tracking and inventory management. Simple and effective.

Freelancers need simple tools. They help track income and expenses. FreshBooks is a good choice. It offers easy invoicing. Also time tracking. Freelancers love its simplicity. It saves time and is user-friendly.

Non-profits need special tools. They track donations and grants. Aplos is popular. It is designed for non-profits. It offers fund accounting. Also helps with donor management. Very helpful for non-profit needs.

Construction requires robust solutions. Contractors need to manage projects. Sage 100 Contractor is ideal. It offers project management features. Also helps in cost estimation. Supports contractors with job costing. Efficient for construction businesses.

:max_bytes(150000):strip_icc()/GettyImages-1442731807-de72b6667831444298d539e63d58693f.jpg)

Credit: www.investopedia.com

Tips For Choosing The Right Software

Understanding your business needs is very important. Identify which tasks are most important. Do you need software for invoicing, payroll, or inventory? List your priorities. This will help you find the best fit. Make sure the software supports your industry. A good match will save time and money.

Money matters when choosing software. Set a clear budget. Look for hidden costs. These can include upgrade fees or extra support. Free trials are helpful. They let you test without spending. Compare prices of different software. Choose one that offers good value.

Testing is important before buying. Use free trials to explore features. Check if the software is user-friendly. Ensure it meets your needs. Look at customer reviews for real feedback. Reviews tell you what works and what doesn’t.

Experts can help you choose the right software. Ask an accountant for advice. They know what features are necessary. Professional advice can save you from costly mistakes. It ensures you pick the best software for your business.

Latest Trends In Accounting Software

Smart software can do many tasks. AI helps in managing accounts. It can check bills and payments fast. Automation saves time. It handles reports with ease. Small businesses love these features. They make work simple. Less effort, more accuracy. It’s a good choice for all.

Cloud software stores data safely. Access it from anywhere. No need for big computers. It helps in sharing files. Easy to update and track. Many small businesses use it. It is affordable and secure. Keeps data safe from loss. A smart way to manage finances.

Blockchain offers safety in transactions. No one can change data. It is transparent and trustworthy. Businesses find it useful for records. Keeps everything clear and fair. Less risk of fraud. Helps in building trust. Small companies benefit a lot. A new way to secure information.

Data analytics helps in smart decisions. It shows trends and numbers. Businesses can plan better. Understand market needs. Analytics gives insights. Helps track progress. Small firms gain from this. It is easy to use. Makes business smarter. A great tool for success.

Frequently Asked Questions

What Is The Best Accounting Software For Small Businesses?

The best accounting software varies by business needs. QuickBooks, FreshBooks, and Xero are popular choices. They offer features like invoicing, expense tracking, and financial reporting. Evaluate your specific requirements and budget to choose the best fit.

How Does Accounting Software Benefit Small Businesses?

Accounting software streamlines financial management. It simplifies tasks like invoicing, expense tracking, and tax preparation. Automating these processes saves time and reduces errors. Additionally, it provides valuable insights into your business’s financial health.

Is Accounting Software Easy To Use For Beginners?

Most accounting software is designed with user-friendliness in mind. Platforms like QuickBooks and FreshBooks offer intuitive interfaces. They provide tutorials and customer support to help beginners. Choosing software with a simple interface can make the learning curve easier.

Can Accounting Software Integrate With Other Business Tools?

Yes, many accounting software solutions integrate with other tools. They can connect with CRM systems, payment processors, and e-commerce platforms. This integration helps streamline operations and improve efficiency. Check the software’s compatibility with your existing tools before choosing.

Conclusion

Choosing the right accounting software is crucial for small businesses. It streamlines tasks, saves time, and reduces errors. Each option offers unique features tailored to different needs. Consider your business size and industry when selecting software. Evaluate your budget and future growth.

Always opt for user-friendly platforms to ensure smooth operation. Don’t forget to check customer support and security features. Reliable software supports your business’s financial health. Make a decision that aligns with your goals and requirements. Start managing finances effectively today.

A better financial process awaits you. Make your choice wisely and prosper.