Are you a small business owner juggling numbers, invoices, and tax deadlines all at once? If so, you’re in the right place.

Finding the best accounting software for your small business can transform your daily operations. Imagine a tool that simplifies your bookkeeping, saves you precious hours, and even helps you make smarter financial decisions. Sounds like a dream, right? But it’s not just a dream; it’s a necessity in today’s competitive market.

Before you start feeling overwhelmed by the endless options out there, let’s dive into what makes certain accounting software stand out. Whether you’re a tech-savvy entrepreneur or someone who just wants the basics, we’ve got insights tailored for you. Keep reading to discover which accounting software could be the game-changer your business needs.

Key Features To Consider

Software should be easy to use. Simple menus help users find tools fast. Clear instructions make work easier for everyone. No need for extra training. User-friendly design saves time and effort.

Good software connects with other apps easily. This helps share data between systems. Look for smooth integration with popular tools. It makes business tasks simple and quick.

Check the pricing before buying. Different software has different price plans. Some may offer monthly or yearly subscriptions. Compare costs and choose what fits your budget.

Software should grow with your business. Choose one that offers scalability. This means you can add more features later. It helps manage more data as business expands.

:max_bytes(150000):strip_icc()/GettyImages-1442731807-de72b6667831444298d539e63d58693f.jpg)

Credit: www.investopedia.com

Top Accounting Software Picks

QuickBooks Online is popular among small businesses. It offers many features for easy accounting. You can track expenses, send invoices, and run reports. It’s suitable for both beginners and experts. The software is also cloud-based, so you can access it anywhere. It helps in managing finances without much fuss.

Xero is a great tool for small businesses. It provides real-time updates on your finances. You can connect it to your bank for easy tracking. Xero also offers smart invoice management. It’s simple to use and very user-friendly. Many people find its interface intuitive.

FreshBooks is known for its time-tracking feature. It helps freelancers and small teams. You can easily create invoices and track time. FreshBooks also offers strong customer support. It’s perfect for those who need simple billing solutions.

Zoho Books is a complete package. It offers inventory management and project tracking. You can automate many tasks using this software. Zoho Books is also affordable for small businesses. It integrates well with other Zoho apps. This makes it a versatile choice.

Wave Accounting is free to use. It’s perfect for very small businesses. You can manage basic accounting tasks with ease. It offers invoicing, receipt scanning, and more. Wave is simple and straightforward. Many small business owners find it helpful.

Comparative Analysis

A simple and clean user interface makes tasks easy. Small business owners prefer software with easy navigation. Software with intuitive design is less confusing. Clear instructions and labels help users learn faster. Bright colors and large fonts improve visibility.

Good customer support is crucial for users. Quick response times are important. Friendly staff make customers feel valued. Support should be available by phone or chat. Tutorials and FAQs can help users solve problems.

Many users need mobile access to their software. Apps should work on phones and tablets. Offline access is a useful feature. Users want to check data on the go. Syncing with desktop versions is important.

Customizability allows users to tailor software to their needs. Different businesses have unique requirements. Software should offer various settings and options. Users like to adjust reports and dashboards. Flexibility in features is key for satisfaction.

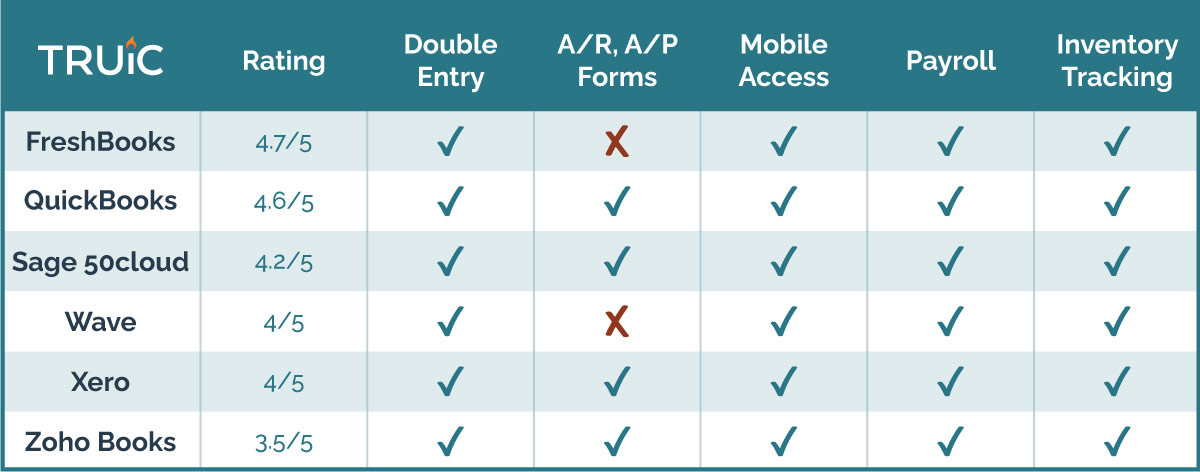

Credit: howtostartanllc.com

Industry-specific Solutions

Retail businesses need software for tracking sales and managing inventory. Accounting software helps in handling transactions efficiently. It generates reports to understand profits and losses. E-commerce platforms integrate with accounting tools easily. This saves time and reduces errors. Retailers can focus more on serving customers. Inventory management becomes simpler with these solutions. They provide insights into customer buying habits. This helps in planning marketing strategies.

Freelancers need software to manage invoices and expenses. Accounting tools help track billable hours. They ensure timely payments from clients. Consultants benefit from tracking project costs. Easy-to-use software boosts productivity. Time spent on paperwork reduces significantly. Financial reports help in planning budgets. These solutions simplify tax calculations. They improve cash flow management. Freelancers enjoy more freedom and less stress.

Construction firms require software for tracking project costs. Real estate agents need tools for managing property sales. Accounting solutions help in budgeting and forecasting. These tools simplify billing processes. They reduce errors in financial transactions. Project managers get real-time updates on costs. Budgeting tools assist in planning future projects. Real estate professionals benefit from streamlined processes. They can focus more on client relationships.

Non-profits need software for managing donations and grants. Accounting tools help in tracking funds received. They ensure transparency in financial dealings. Reports generated help in auditing. Financial statements show how funds are used. Budgeting features assist in planning future activities. They simplify donor management and reporting. These solutions enhance credibility and trust. Non-profits focus on achieving their mission effectively.

Security And Data Protection

Data Encryption Standards keep your information safe. They change data into codes. This makes it hard for bad people to read. The best accounting software uses strong encryption. This keeps your money details secure. Encryption is like a lock. Only you have the key.

User Access Controls help protect your data. They let you decide who sees what. You can give different people different rights. Some can only read data. Others can change it. This stops mistakes and keeps data safe.

Backup and Recovery Options save your data. If something goes wrong, backups help. You can get your data back. This is important if your computer breaks. It also helps if there is a virus. Backups keep your business running smoothly. Backups are like a safety net.

Future Trends In Accounting Software

AI and Automation are changing accounting. Computers do tasks faster. They make fewer mistakes. This helps small businesses save time. They also save money. Software can now do many jobs. It can manage invoices. It can track expenses. It can also predict future trends.

Blockchain Technology makes data safe. It keeps records secure. No one can change them without permission. This is good for trust. Businesses can share data easily. They know it is safe. It helps with audits. It also helps with tax reports.

Cloud-Based Solutions are popular now. They store data online. This means you can access it anywhere. Businesses can work from home. They can work while traveling. It also makes teamwork easier. Everyone can see updates in real-time. This helps with communication.

Choosing The Right Software

Small businesses have different needs. Accounting software should fit these needs. Think about your budget. Look for features you need most. You might need invoicing or payroll. Ease of use is important too. You want software that’s simple. Check if it works on mobile. Many businesses need this.

Try software before buying. Free trials help with this. Use these trials wisely. Test all features you need. See if it’s easy to use. Check speed and performance. Slow software wastes time. Ask your team to test it. Their feedback is valuable. Testing helps avoid mistakes.

Accountants know best. Ask their advice about software. They understand your needs. Share your goals with them. They can suggest useful tools. Accountants also spot issues early. Their experience is valuable. Use it to choose better. Collaboration leads to good decisions.

Credit: bestaccountingsoftware.com

Frequently Asked Questions

What Is The Best Accounting Software For Small Businesses?

The best accounting software depends on your specific needs. QuickBooks, FreshBooks, and Xero are popular choices. They offer features like invoicing, expense tracking, and financial reporting. Each has unique strengths, so consider your business requirements before deciding.

How Does Accounting Software Benefit Small Businesses?

Accounting software simplifies financial management. It automates tasks like invoicing, expense tracking, and payroll. This saves time and reduces errors. It also provides real-time insights into your financial health, helping you make informed decisions and ensuring compliance with tax regulations.

Is Cloud-based Accounting Software Secure?

Yes, cloud-based accounting software is generally secure. Providers use encryption and multi-factor authentication to protect data. Regular backups ensure data safety. Always choose reputable providers and follow best practices, like using strong passwords, to enhance security.

Can Accounting Software Grow With My Business?

Yes, most accounting software is scalable. It can accommodate increased transactions and users as your business grows. Features like advanced reporting, integration with other tools, and multi-currency support are available in higher plans, ensuring the software evolves with your needs.

Conclusion

Choosing the right accounting software boosts small business success. It simplifies managing finances and saves time. Explore options to find what suits your needs best. Consider features like ease of use and support. Budget is important too. Some tools offer free trials.

Test them to see if they fit your workflow. Remember, the best software makes tasks simpler. It helps track expenses and generates reports. Stay organized, and focus on growing your business. Reliable accounting tools are key to smart financial management.

Make informed choices for a smoother business journey.