Choosing the right accounting software can make or break how smoothly your business runs. If you’ve been stuck between QuickBooks and Xero, you’re not alone.

Both promise to simplify your finances, but which one truly fits your needs? This guide will help you see the clear differences, so you can make a confident choice without wasting time or money. Keep reading to discover which tool will give your business the edge it deserves.

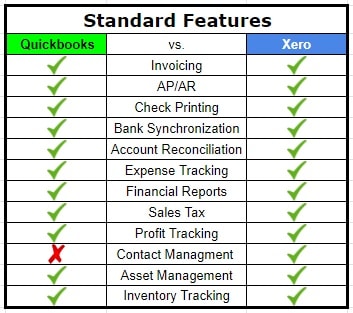

Credit: www.chargebee.com

Key Features Comparison

Comparing QuickBooks and Xero means looking at their core features. These features help businesses manage money and save time. Each platform offers tools to handle common accounting tasks. This section breaks down key features to help you understand what each software provides.

Invoicing And Billing

QuickBooks offers customizable invoices. You can add logos and payment terms. It supports automated reminders for unpaid bills. Xero also lets you create professional invoices. It includes options for recurring invoices and online payments. Both allow easy tracking of invoice status.

Expense Tracking

QuickBooks simplifies expense tracking by connecting bank accounts. You can snap photos of receipts using its app. Xero provides similar expense features with smart categorization. It also allows attaching receipts to transactions. Both help keep expenses organized and clear.

Bank Reconciliation

QuickBooks automatically matches bank transactions with records. It helps find errors quickly. Xero offers real-time bank feeds for smooth reconciliation. It highlights discrepancies for easy review. Both reduce manual work in balancing accounts.

Reporting And Analytics

QuickBooks provides a wide range of reports. Users can customize reports to fit their needs. Xero offers detailed financial reports and visual charts. It supports exporting reports for sharing. Both help businesses understand their financial health.

Mobile App Functionality

QuickBooks mobile app allows invoicing and expense tracking on the go. It syncs data instantly with the desktop version. Xero’s app also supports invoicing and bank reconciliation. It offers a clean, user-friendly interface. Both apps keep your accounting updated anywhere.

Credit: www.meruaccounting.com

Pricing And Plans

Pricing and plans play a key role in choosing accounting software. Both QuickBooks and Xero offer multiple options. They suit different business sizes and needs. Understanding their costs helps make a wise choice.

Subscription Costs

QuickBooks has several plans starting from a low monthly fee. Each plan offers more features at higher prices. Xero also offers tiered plans. These plans vary by the number of users and features. Both services charge monthly or annual fees.

Free Trial Options

QuickBooks offers a 30-day free trial. This lets users explore most features. Xero provides a 30-day free trial too. It allows full access to the software during this period. Free trials help test which software fits best.

Add-on Services Pricing

QuickBooks offers extra services like payroll and payment processing. These add-ons cost more each month. Xero also has add-ons such as payroll and project tracking. Prices depend on the services chosen. Add-ons help customize the software for your needs.

User Experience

User experience plays a big role in choosing accounting software. It affects how fast you learn and how well you manage your finances. QuickBooks and Xero both offer solid experiences. Each has strengths that suit different users. Let’s explore their user experience in detail.

Interface Design

QuickBooks has a clean and familiar layout. Menus and tools are easy to find. The dashboard shows key info clearly. Users can customize the view to see what matters most.

Xero’s interface is bright and modern. It uses simple icons and clear labels. The design feels fresh but stays easy to navigate. Users can move quickly between tasks.

Ease Of Use

QuickBooks guides users with helpful prompts. It suits beginners who want step-by-step help. Setting up accounts and invoices is straightforward. The software also supports shortcuts for experts.

Xero focuses on simplicity. It keeps the steps minimal and clean. Users can connect bank accounts fast. Many find it easy to track money and bills without confusion.

Customer Support

QuickBooks offers support via phone, chat, and community forums. Response times are usually quick. The help articles cover many common questions.

Xero provides 24/7 online support through email and live chat. They have a detailed knowledge base. Users can join webinars for extra learning.

Credit: sharedeconomycpa.com

Integration Capabilities

Integration capabilities are key for accounting software. They help connect different tools and systems. This makes business tasks smoother. Both QuickBooks and Xero offer strong integration options. They support many apps and services. These connections save time and reduce errors. Let’s explore how each handles integrations in detail.

Third-party Apps

QuickBooks supports over 700 third-party apps. These apps cover invoicing, inventory, time tracking, and more. Many popular business tools work well with QuickBooks. Xero also connects with more than 800 apps. It offers strong options for small and medium businesses. Both platforms keep adding new apps to expand their reach.

Payment Gateways

QuickBooks integrates with popular payment gateways like PayPal and Stripe. This helps businesses accept payments quickly. Xero supports many payment options too. It connects with gateways such as Square and Worldpay. Both platforms allow easy payment processing inside the software.

Payroll Systems

Payroll integration simplifies employee payment and tax tasks. QuickBooks has its own payroll service in the US, Canada, and UK. It also supports other payroll apps. Xero offers payroll in some countries and works with third-party payroll providers. Both give reliable options to manage payroll efficiently.

Security And Compliance

Security and compliance are vital for any accounting software. Protecting financial data builds trust and prevents legal problems. Both QuickBooks and Xero offer strong security features and follow important rules. Understanding their approaches helps you pick the right tool for your business.

Data Protection Measures

QuickBooks uses encryption to keep data safe during transfers. It also limits access with strong passwords and two-step verification. Xero encrypts data with secure protocols and monitors for unusual activity. Both platforms store data in secure data centers with strict controls.

Regulatory Compliance

QuickBooks complies with standards like GDPR and SOC 2. It helps businesses meet tax and financial reporting rules. Xero also follows GDPR and industry standards. It provides audit trails to track changes and support transparency. Both meet key requirements for small and medium businesses.

Backup And Recovery

QuickBooks regularly backs up data automatically on the cloud. It offers easy recovery options if data is lost. Xero also performs frequent backups and stores copies in different locations. Its recovery process is fast and reliable. Both protect your data against accidental loss or cyber threats.

Suitability For Business Types

Choosing the right accounting software depends on the type of business you run. QuickBooks and Xero both serve different business needs well. Each platform offers features that suit certain business sizes and industries. Understanding which software fits your business type helps you manage finances better. Below is a guide to see how QuickBooks and Xero match various business types.

Small Businesses

QuickBooks is popular among small businesses. It offers easy setup and simple tools to track income and expenses. Small business owners can manage invoices and payroll without much hassle. Xero also supports small businesses with its clear interface and mobile app. It helps with bank reconciliation and basic reporting. Both tools save time for small business owners, but QuickBooks tends to have more local support options.

Freelancers And Contractors

Freelancers and contractors need simple, flexible software. QuickBooks provides useful features like time tracking and invoice customization. It helps freelancers keep an eye on payments and taxes easily. Xero offers similar options with an emphasis on cloud access. Freelancers can work from anywhere and connect multiple bank accounts. Xero’s automatic bank feeds make daily tasks faster. Both platforms suit freelancers, but Xero often shines with its usability on mobile devices.

Medium To Large Enterprises

Medium and large businesses require advanced features and team collaboration. QuickBooks offers robust reporting and inventory management. It supports multiple users with different access levels. Xero excels in integration with other business apps and handles complex accounting needs. It provides strong tools for budgeting and cash flow forecasting. Large teams benefit from Xero’s cloud-based collaboration features. Both platforms can scale, but Xero may better suit businesses needing extensive app connections.

Pros And Cons

Choosing the right accounting software is key for small businesses. QuickBooks and Xero both offer strong features. Understanding their pros and cons helps make a better choice. This section breaks down the advantages and limitations of each tool.

Advantages Of Quickbooks

QuickBooks has a large user base and many features. It supports invoicing, expense tracking, and payroll. Users find its interface familiar and easy to use. The software integrates with many third-party apps. It offers strong reporting tools for financial insights. Customer support is available through various channels. QuickBooks also provides mobile apps for on-the-go access. It suits businesses of many sizes and industries.

Advantages Of Xero

Xero is known for its simple and clean design. It offers unlimited users at no extra cost. The software supports bank reconciliation automatically. Xero allows easy collaboration with accountants and team members. It has a good range of integrations with other software. Users can manage multiple currencies with ease. Xero’s dashboard gives a clear view of finances. It also provides strong security features to protect data.

Limitations To Consider

QuickBooks can be expensive for small startups. Some users find its pricing plans confusing. The software may have a steep learning curve. Occasional glitches appear during updates. Xero’s payroll features are limited in some countries. It lacks some advanced reporting options. Customer support can be slow at times. Both tools require internet access to work well. Knowing these limits helps avoid surprises later.

Frequently Asked Questions

What Are The Main Differences Between Quickbooks And Xero?

QuickBooks offers robust bookkeeping with advanced reporting. Xero excels in user-friendly design and seamless bank integration. QuickBooks suits larger businesses, while Xero fits small to medium enterprises needing simple accounting.

Which Software Is Better For Small Businesses, Quickbooks Or Xero?

Xero is ideal for small businesses due to its intuitive interface and affordable plans. QuickBooks provides more features but may be complex for beginners. Both offer strong accounting tools, but Xero focuses on ease of use.

How Do Quickbooks And Xero Compare In Pricing?

QuickBooks pricing is tiered with more expensive plans for advanced features. Xero offers straightforward monthly subscriptions with unlimited users. Xero generally costs less for basic accounting, while QuickBooks charges extra for additional services.

Can Quickbooks And Xero Integrate With Other Business Apps?

Yes, both QuickBooks and Xero support integrations with popular apps like PayPal, Shopify, and Stripe. Xero has a larger app marketplace, enhancing customization. QuickBooks offers strong ecosystem support, especially for payroll and tax apps.

Conclusion

Choosing between QuickBooks and Xero depends on your business needs. Both offer strong features for accounting and invoicing. QuickBooks suits users who want simple, familiar tools. Xero appeals to those who prefer cloud-based, flexible options. Consider your budget, ease of use, and customer support.

Try free trials to see which fits best. The right choice helps manage your finances smoothly. Take time to compare features carefully. Your decision will impact daily business tasks. Make sure the software matches your growth plans and skills.