Managing your invoices can feel overwhelming, especially when deadlines pile up and mistakes slip through. But what if you could simplify the entire process and save time, reduce stress, and get paid faster?

You’ll discover practical tips that make handling invoices easier and more efficient. By the end, you’ll have clear steps to take control of your billing and keep your cash flow steady. Ready to transform the way you manage your invoices?

Keep reading.

Streamline Invoice Creation

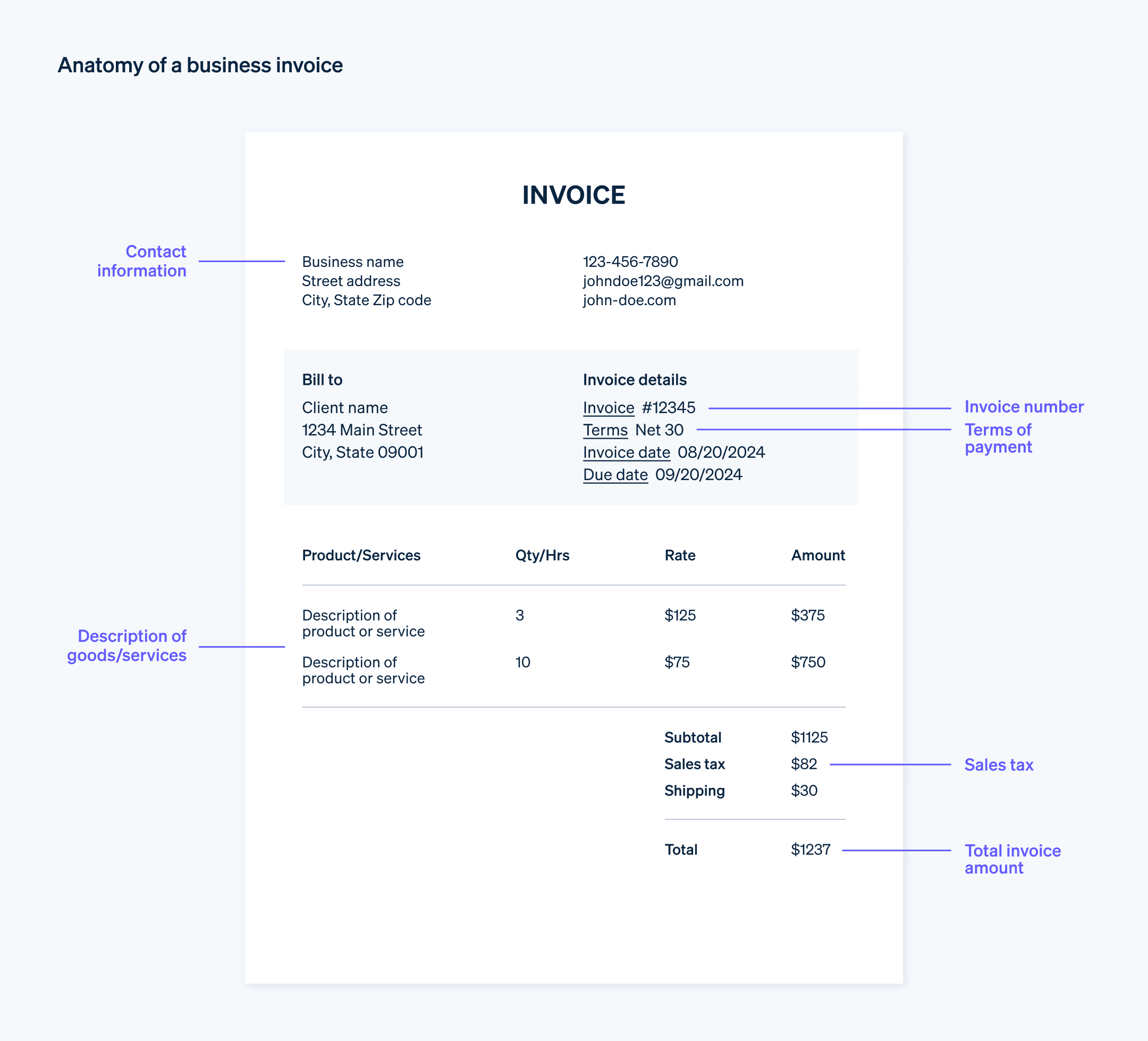

Using invoice templatessaves time and keeps your bills neat. Templates help you fill in details quickly. You only change dates, names, and amounts. This reduces errors and keeps your invoices consistent.

Automating recurring invoicesmeans you don’t send bills by hand every time. This is good for regular customers. The system sends invoices on set dates. It helps you get paid faster and avoids missed invoices.

Credit: stripe.com

Organize Invoice Records

Using a digital filing systemhelps keep all invoices in one place. Files can be sorted by client nameand date. This method saves time and reduces errors.

Folders named after each client make it easy to find invoices quickly. Inside, invoices can be arranged by date for better tracking. This system helps you see which invoices are paid or unpaid.

Back up files regularly to avoid data loss. Use simple file names with the client and date to stay organized. This keeps your records neat and easy to manage.

Set Clear Payment Terms

Clear payment termshelp avoid confusion and delays. Always define due datesclearly on invoices. This tells customers exactly when to pay. Use simple dates like “Pay by June 10.”

Late payment policiesprotect your business. State the fee for late payments, such as a small percentage or flat fee. Also, mention when the fee applies, for example, after 10 days past due.

Be fair but firm. Remind customers politely if payment is late. This keeps good relationships and encourages timely payments.

Credit: www.rippling.com

Utilize Invoice Management Tools

Choosing the right invoice softwarehelps save time and reduce errors. Look for tools that are easy to useand fit your business needs. Some software offers automatic remindersfor unpaid invoices. This keeps payments on track.

Integrating invoice software with your accounting systemmakes managing finances simple. It helps avoid double entryand keeps records accurate. Syncing data means you can generate reports quickly. This also helps with tax preparationand audits.

Enhance Communication With Clients

Sending timely remindershelps clients remember due payments. Reminders should be polite and clear. A short message a few days before the due date works well. Follow up with another reminder if the payment is late. This reduces delays and improves cash flow.

Clarifying payment methodsavoids confusion. Clearly state all accepted payment options like bank transfer, credit card, or online payments. Provide detailed instructions for each method. This makes it easier for clients to pay on time. Include contact info for questions about payments.

Credit: www.meruaccounting.com

Monitor Invoice Status Regularly

Keeping a close eye on pending and paid invoiceshelps avoid late payments. Use a simple list or spreadsheet to mark which invoices need attention. This saves time and reduces errors. Regular checks make sure no invoice is forgotten.

Creating payment reportsshows a clear view of money coming in and going out. Reports can be weekly or monthly. They help spot trends and plan better. A clear report keeps finances organized and easy to understand.

Handle Disputes Efficiently

Responding quicklyto questions about invoices helps keep trust. It stops small problems from growing. Always check the details carefully before replying. Clear answers make it easier to solve issues fast. This shows you value your clients’ time.

Negotiating adjustmentsfairly is key to good business. Listen well to the other side’s points. Find a middle ground that works for both. Fair deals build strong relationships and repeat business. Avoid rushing or being too tough.

Maintain Compliance And Security

Following tax ruleshelps avoid fines and legal troubles. Keep all invoices clear and correct. Use the right tax rates and update them often. Save records for the time the law says. This makes audits easier and faster.

Protecting private datais key. Store invoices in safe places with passwords. Only share invoice info with trusted people. Use software that keeps data safe from hackers. Back up data regularly to avoid loss.

Frequently Asked Questions

What Is The Best Way To Organize Invoices Efficiently?

Use digital tools or software to categorize and store invoices. Label them by date, client, or project for easy retrieval. Consistent organization reduces errors and saves time during audits or payments.

How Can Automation Improve Invoice Management?

Automation speeds up invoice processing and reduces manual errors. It allows automatic reminders, quick approvals, and faster payments. This leads to better cash flow and improved financial accuracy.

Why Is Timely Invoice Tracking Important?

Timely tracking ensures you never miss payment deadlines. It helps identify overdue invoices quickly, improving cash flow. Regular monitoring also aids in accurate financial reporting and budgeting.

What Are Common Invoice Management Mistakes To Avoid?

Avoid late payments, disorganized records, and ignoring invoice discrepancies. Missing details or delays can harm client relations and cash flow. Regular reviews and clear communication prevent these issues.

Conclusion

Efficient invoice management saves time and reduces errors. Keep your records clear and organized. Use simple tools to track payments quickly. Set reminders to avoid late fees and confusion. Regular checks help catch mistakes early. Clear communication with clients speeds up payments.

Following these tips makes your work easier. Stay consistent and watch your process improve. Small changes lead to better financial control. Manage invoices well to support your business growth.